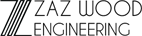

Walnut Handmade Carved Bed

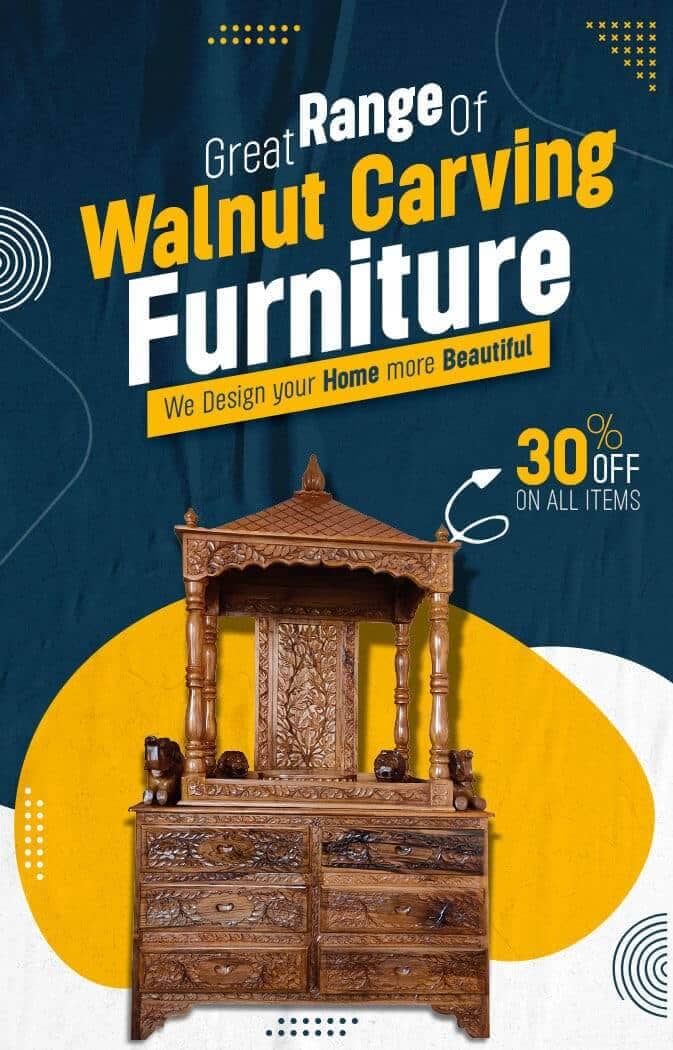

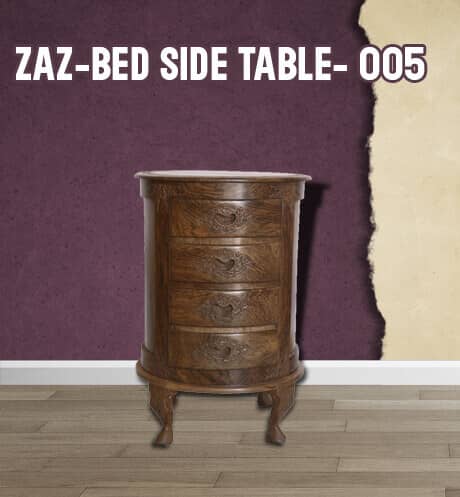

Walnut Handmade Bed Side Table

Furniture Manufacturers in whole India.

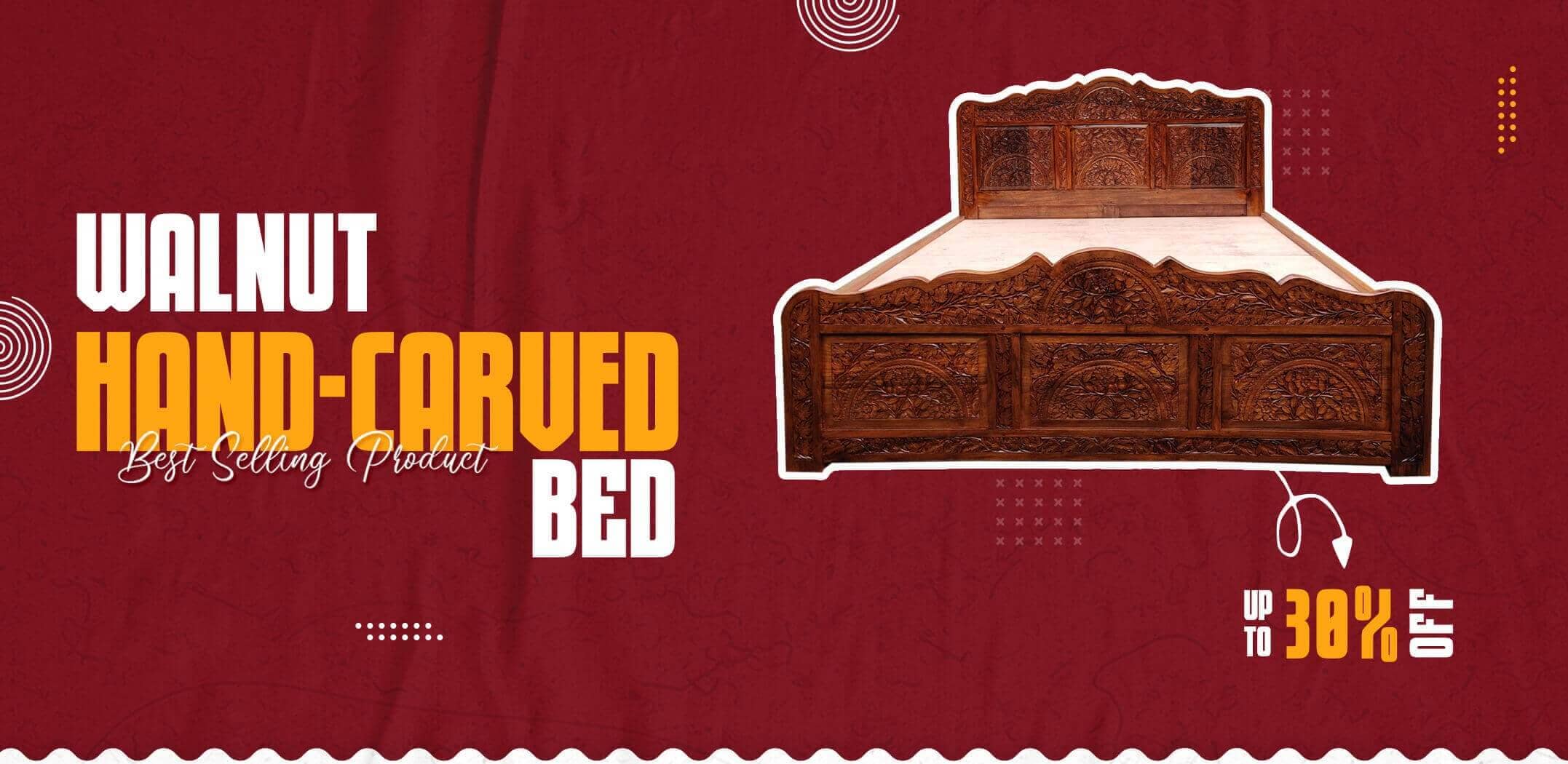

An authentic handmade walnut wood furniture manufacturing company based in Srinagar, manufacturing and supplying royal luxury hand-carved walnut furniture in whole India.. We are the perfect stop for those who follow the royal lifestyle and believe in quality. We manufacture almost every home and office furniture like handmade walnut wood Beds, Sideboards, sofa sets, coffee tables, dining tables & office tables. We are in this business for 80 years and have gained the trust of thousands of clients. We can also customize our products as per your need and taste. We have a highly-skilled craftsman who has experience of more than 40 years of in the same field. The designs and structures of our products are exquisite. We mainly use walnut and cedar wood for our furniture, which is found in the northern Himalayas. Walnut is known for its hardness, grains, and brownish color. Every piece of furniture is manufactured by hand, carving, and polishing are also done by hand. In addition to this, we are the ones who don't consider others as competition because we follow a different mind-set, different nature, and an outstanding approach in terms of our business. We are big-time believers & followers of customer relationship management, we want our clients to come back to us and that would help us retain a new set of loyal customers. Our brand promise is of extremely high value, we never compromise over it.

ABOUT US

we can help decorate a home, office or retail store with unique, beautiful custom-made walnut wood furniture that lasts for centuries. We specialize in the use of walnut wood & cedar wood for furniture & interiors with excellent hand carving. Every design is need and space-based and aims to offer maximum utilization and value for a given piece of furniture. We use treated and seasoned wood to provide longevity to the furniture. Walnut is a strong, hard and durable wood that carves well and holds a good shape for a number of years. This makes it is an excellent choice for luxury furniture that requires hand carving. Walnut furniture can easily last a lifetime with proper care and maintenance.Their Words, Our Pride Happy Words of our Happy Customers